The “Japan bubble” Revealed through the “Statements of Large-Volume Holdings”: Its Logical Development Possibilities

While the global financial markets are being shaken by the banking crisis due to the “SVB shock,” the following news was reported in Japan:

- The UK-based investment management company Silchester International Investors was found to hold 5.04% of the shares of the Japanese internet company DeNA. (*1)

- Silchester owns 5.05% stake in Dentsu Group Inc. (*2)

- Regarding Oisix, JP Morgan Asset reported holding over 5%. (*3)

- Silchester International Investors has proposed a special dividend of 12 yen per share to Obayashi Corporation as an agenda item for the annual general meeting of shareholders to be held in June. (*4)

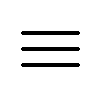

(Figure: Stock Trends of DeNA)

(Source: Yahoo Finance)

In the world of “information literacy,” the release of such public reports should be interpreted as having a “hidden agenda.” So, what is this “hidden agenda”?

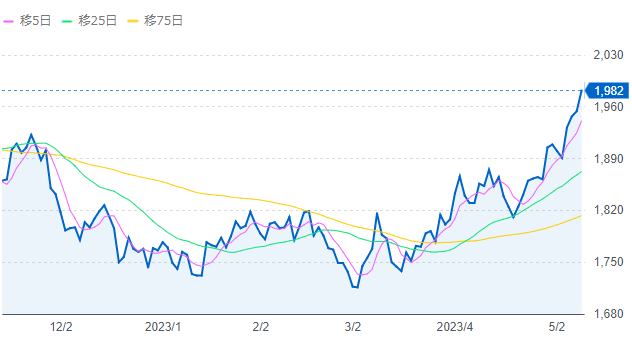

The history of foreign funds investing in Japan reveals their intentions. The history of foreign funds’ investment in Japan can be traced back to the 1960s and shows that there have been several “foreign investment booms” up to the present day, as follows (*5):

- 1961~1962: American Depositary Receipts (ADRs) were issued for Sony and Honda

- 1967~1970: Japan became an article VIII country of the IMF or a member of the OECD

- 1971~1972: Yen appreciates as a result of the Smithsonian Agreement

- 1979~1982: Oil Money Rushes to Japan

- 1983~1984: Principle of actual demand for foreign exchange futures transactions eliminated (*6)

- 1990: Under the global stock market boom, international diversification began

- 1995~1996: Foreigners expected Japan’s structural reforms and bought Japanese stocks

- 1999: IT-related stocks were bought in both Japan and the U.S. during the IT boom

- 2001: U.S. funds bought profitable stocks such as pharmaceuticals and electronics

- 2005~2007: Due to the recovery of the Japanese economy and the increase of global investment in risk assets, foreign investors have intensified their investment in Japanese equities

- 2012~2015: Prime Minister Abe took office in 2012 and developed aggressive economic policies (Abenomics), which rekindled foreign investors’ interest in Japanese equities.

(Figure: Share of foreign investors)

(Source: Ministry of Finance)

In this context, it is important to pay attention to ‘large shareholding reports’. In Japan, like in other countries, it is mandatory to submit a “Statements of large-volume holdings” when holding more than 5% of the share certificates, etc. of a listed company or investment securities, etc.

Here, as an example, let’s take a look at Sony’s annual securities report and see what foreign investors are doing as follows (*7):

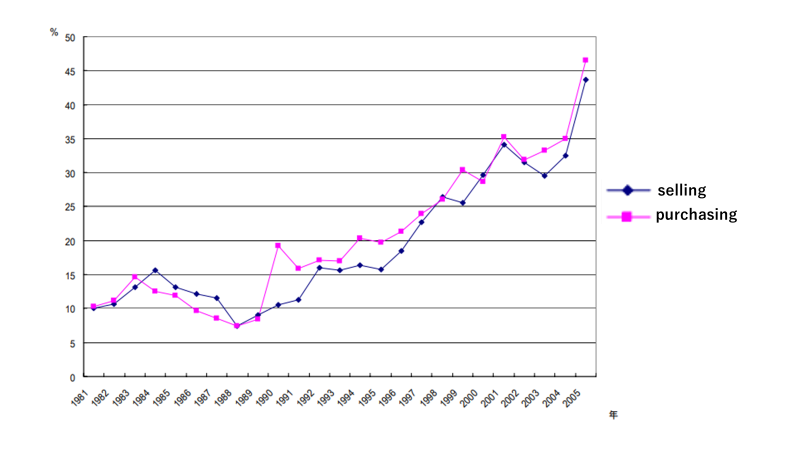

- In 1961, Moxley & Company, the nominee for JPMorgan Chase Bank’s shares as trustee for ADRs, acquired 8.3% of the shares

- In 1973, this share rose to 40.7%

- In 1982, British and Swiss investment firms also entered the fray as follows:

- Lloyds Bank International Limited London: 1.51%

- Swiss Credit Bank Zurich: 1.32%

- Moxley & Company: 33.51%

- However, in 1989 and 1990, Moxley disappeared from the list of major shareholders

- In 1991 and later, Moxley’s name reappears

(Figure: Stock Trends of SONY)

(Source: TradingView)

The above trends indicate that foreign investors started investing before the Heisei Bubble and then sold out before the bubble burst.

According to Japan Exchange Group, foreign investors have been predominantly buying stocks in recent months (*8).

Hence, the acceleration of foreign investment in Japan, as seen in reports such as the “Large Volume Holdings Report,” can be said to be a sign of the eve of a “Japan bubble.”

However, based on the Le Chatelier’s principle, the return of the “Japan bubble” also means that a “Japanese default” is imminent. If foreign investors start quietly withdrawing, it may mean that we are on the eve of a default.

*1 https://jp.reuters.com/article/silchester-dena-idJPKCN2M0065

*2 https://www.tradingview.com/news/reuters.com,2023:newsml_T9N34W021:0/

*3 https://kabutan.jp/news/marketnews/?b=n202305020746

*4 https://www.nikkei.com/article/DGXZQOUC258CW0V20C23A4000000/

*5 https://www.mof.go.jp/policy/international_policy/research/fy2005kenkyukai/1803shikinfurou_18.pdf

*6: https://www.mof.go.jp/policy/international_policy/gaitame_kawase/gaitame/hensen.html

*7: https://www.sony.com/ja/SonyInfo/IR/library/yu.html

*8 https://www.jpx.co.jp/markets/statistics-equities/investor-type/04-00-archives-01.html

Hiroyasu HARADA

Manager (Senior Analyst), Global Intelligence Group (GIG)