Status Quo of Digital Yen: The Key to Social Implementation

Discussions, research, and even implementation are underway in various countries for CBDC (Central Bank Digital Currency).

In October 2020, the Bahamas became the first country in the world to implement CBDC. Jamaica and Nigeria followed later. China has announced its intention to expand the pilot experiment of digital renminbi, which had been conducted mainly in major cities, to all provinces in the future.

However, its diffusion in society is still at a low level. In the Bahamas, the ratio of CBDC to outstanding banknotes and coins at the end of 2022 is less than 0.2%. In China, it is even lower at 0.1%.

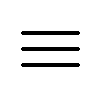

In China, digital renminbi is being tested at four major commercial banks (Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, and Bank of China). For example, the terms of service of China Construction Bank show that the structure of the digital renminbi “e-wallet” is divided into four tiers, from “Tier 1” to “Tier 4,” with each tier placing limits on the amount that can be spent.

(Figure: The Digital Renminbi)

(Source: China US Focus)

“Tier 1” is supposed to have no restrictions like black cards and platinum cards. On the other hand, the most restrictive “Tier 4” is not very large, with a daily settlement amount of RMB 500 or less. “Tier 2” has a maximum holding limit of RMB 10,000.

If all Chinese citizens were to hold “Tier 2” digital renminbi, then theoretically 14 trillion yuan of digital renminbi would be issued, which is more than the 11 trillion yuan of bills issued by the People’s Bank of China.

(Figure: The digital yuan’s two tier structure)

(Source: DEA)

In practice, however, it has not yet been widely used. This is probably because CBDC is not yet user-friendly for economic agents such as households and businesses. Therefore, major countries have recognized the importance of close cooperation between central banks and commercial banks and private businesses.

In Japan, the Bank of Japan is conducting a demonstration experiment from 2021. The Ministry of Finance has begun discussions with a panel of experts in April 2023. The members of that expert panel are as follows (*1):

- Kaori Ishii, Professor, Chuo University

- Satoshi Inoue, Lawyer, Nagashima Ohno & Tsunematsu

- Tetsuya Inoue, Senior Researcher, Nomura Research Institute

- Yuri Okina, Chairperson of the Institute, Japan Research Institute

- Satoshi Osanai, Senior economist, Daiwa Institute of Research

- Shigeki Kunieda, Professor, Chuo University

- Yasuko Kono, Director, Japan Consumers’ Association

- Shuji Kobayakawa, Professor, Meiji University

- Noriyuki Yanagawa, Professor, The University of Tokyo

This shows that three of the nine members were selected from private financial think tanks. This indicates that in Japan, as in other major countries, the central bank and the private sector are planning to work together.

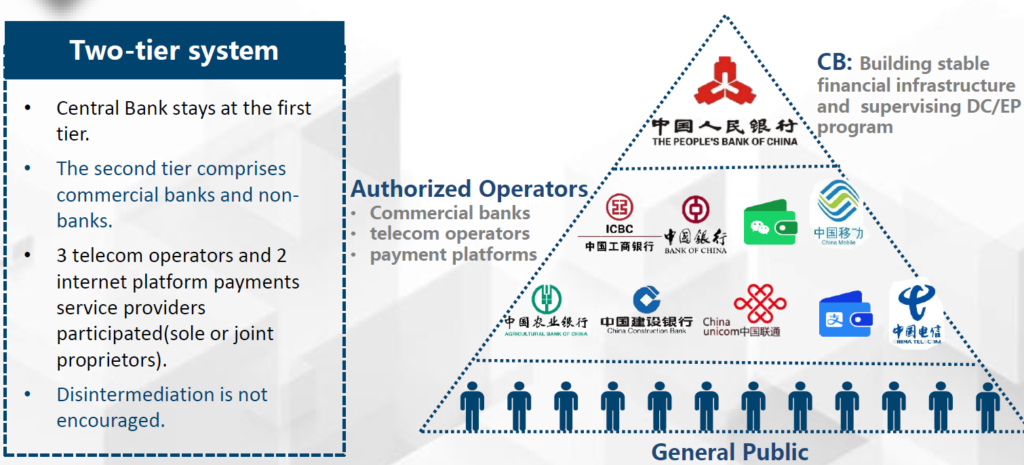

In Japan, many private digital money systems are already in use, even if only for transportation, as shown in the figure below:

(Figure: Ten major IC cards in Japan)

(Source: Japan-guide.com)

Thus, various types of private digital money are already in widespread use. However, a problem can be pointed out that money cannot be transferred between multiple services.

If the digital yen can serve as a bridge between such private digital money, the digital yen will spread rapidly in Japan. This will also help private companies to improve their services in order to hold on to their customers and increase the contestability of the market.

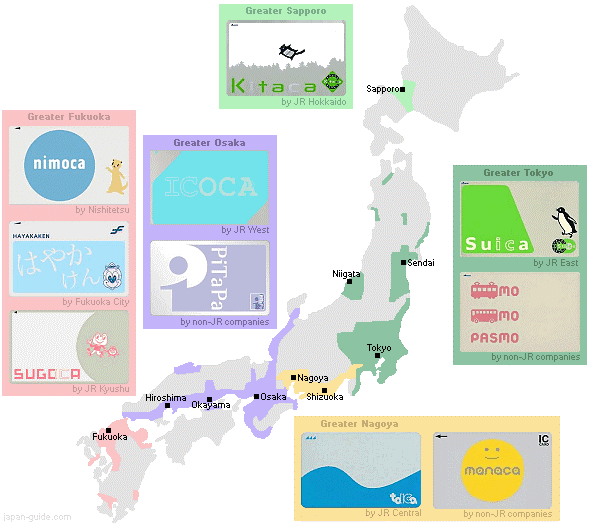

The key will be the movement of banks that provide services directly to users. The following table ranks the total assets of Japan’s megabanks:

(Figure: Top 20 banks in Japan by total assets)

(Source: S&P Global)

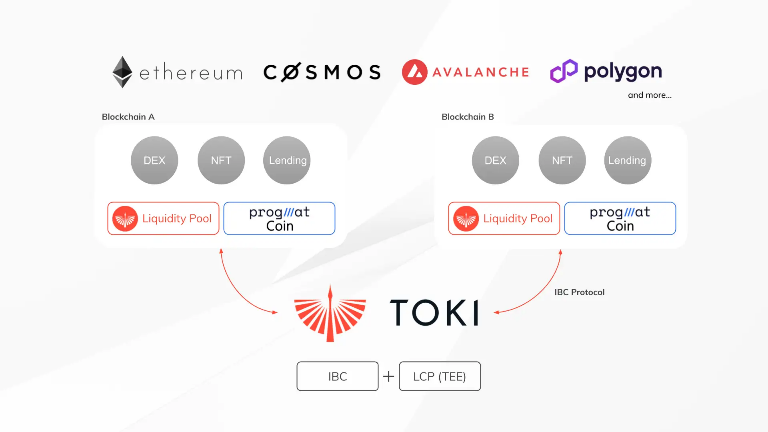

Mitsubishi UFJ Financial Group (MUFG), which owns Bank of Mitsubishi UFJ, Japan’s largest megabank, has announced that it is partnering with Datachain Corporation and TOKI FZCO to build a stablecoin cross-chain infrastructure (*2).

These stable coins are expected to be issued and distributed as soon as the intermediaries handling them complete their license registration, in light of the implementation of the revised Funds Settlement Law in 2023 (*3).

(Figure: Mechanism of Cross-Chain Swaps)

(Source: medium)

The creation of a cross-chain swap infrastructure that would allow settlement with stabled coins on these different blockchains would be an important step in bridging the gap between private digital money.

Will the digital yen become widespread only by improving and examining such technical or practical aspects? The answer would be no.

In 2019, Libra, a virtual currency led by META (formerly Facebook), envisioned a grand future of building a financial infrastructure for global financial inclusion. However, its hasty and overzealous approach led to the appearance of stepping on the tiger’s tail of the U.S. authorities, and as a result, the company had to pull out.

For the social implementation and diffusion of digital currency, we need not only convenience and technical capabilities, but also a vision for the future like the one Meta has depicted.

Although the digital yuan will have restrictions on its use by tier, the digital yen should be a model case for CBDC by embodying financial inclusion, where everyone can access and benefit from financial services without being left behind.

*1 https://www.mof.go.jp/about_mof/councils/meeting_of_cbdc/20230414.html

*2 https://coinpost.jp/?p=465269

*3 https://prtimes.jp/main/html/rd/p/000000081.000036656.html

Hiroyasu HARADA

Manager (Senior Analyst), Global Intelligence Group (GIG)