Japan’s Bubble as an “EXIT” from the Current Drifting Depreciation of JPY

The Japanese yen has fallen to a 20-year low on rising U.S. Treasury yields. History has proven that such a currency market turnaround will lead to a turnaround in the stock market. Hence, this report looks back at the bubble economy (the so-called “Heisei Bubble”) that took place in Japan between 1986 and 1991 and analyzes prospective market trends.

(Figure: The night view of Tokyo)

(Source: THE GATE)

Before the “Heisei Bubble,” Japan was in a “recession” due to the strong yen. The main factor behind the strong yen was the Plaza Accord signed in 1985. By the end of July 1986, the exchange rate had jumped to ¥154.15 to the dollar. This strong yen, combined with soaring land prices, created the “Heisei Bubble” lasting for 51 months from December 1986 to February 1991.

How did foreign investors, including so-called “cross-border investors,” view Japan on the eve of the bubble economy at that time? The American journalist Nicholas D. Kristof wrote the following article in the “New York Times” on August 31, 1986:

―THE YEN RAPIDLY COME OF AGE

―Sometime over the next year, Los Angeles County is likely to become the first American municipal government to borrow Japanese yen. It would thus join a host of big corporate borrowers, among them the likes of I.B.M. and Walt Disney, that are taking advantage of low Japanese interest rates to issue bonds in yen rather than in dollars

―The yen’s dramatic 40 percent rise in value against the dollar since early 1985 has raised speculation that the yen might someday rival the dollar as the paramount international currency

About three months after this article, the “Heisei Bubble” began.

(Figure: The print edition of The New York Times)

(Source: The New York Times)

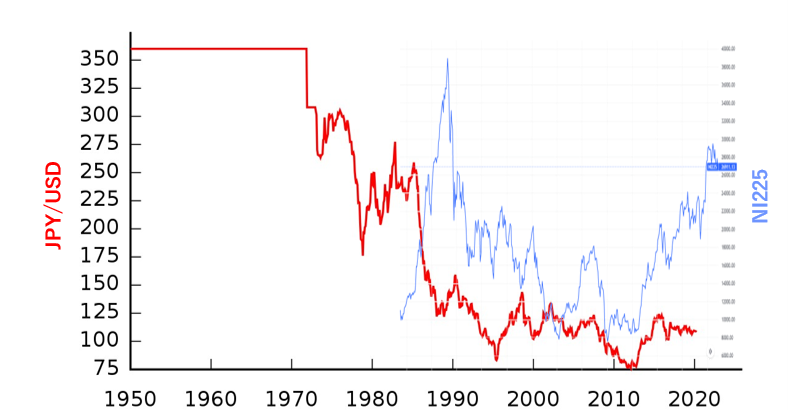

A graphical comparison of the relationship between the yen-dollar rate and the Nikkei Stock Average (NI225) at that time is as follows:

(Figure: The relationship between the yen-dollar rate and the Nikkei Stock Average (NI225))

(Source: Created by the author based on Wikipedia)

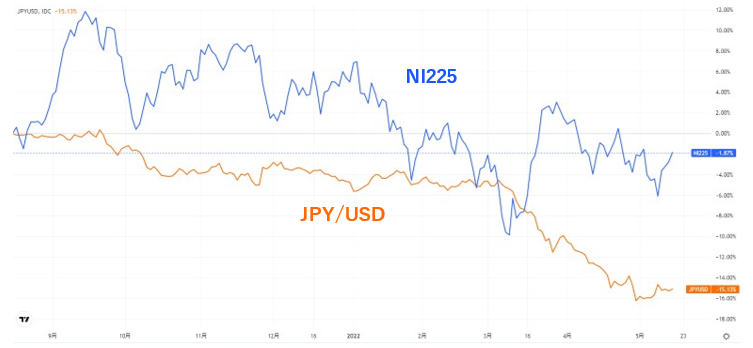

A graphical comparison of the relationship between the yen-dollar rate and the Nikkei Stock Average (NI225) at that time is as follows:Regarding recent currency trends, “Cross-Border Investment Entities” stated the following:

―The yen may extend declines to 140 per dollar and that could trigger the Japanese government to spend $100 billion to limit further losses, according to Bank of America

―Goldman sees the yen falling further with or without Intervention

―Goldman says the yen shows significant value as a recession hedge

All of these “cross-border investors” suggest a “strong yen.” On the other hand, while a weak yen is supposed to have a positive impact on the Japanese economy, especially the Nikkei Stock Average, recent Japanese media have, curious to say, picked up on the “weak yen bad theory” that many sectors may be more damaged by the weak yen than those that benefit from it.

In any case, following the “Le Chatelier’s principle,” a sharp depreciation of the yen might be a prelude to a sharp appreciation of the yen.

In light of the above, what scenarios might be possible in the future?

Firstly, the “Plan A” is as follows:

It might be pointed out that the benefits of the weak yen are gradually emerging, in line with the positive news that Sony and Toyota have recorded the highest profits ever, and additionally, the lifting of the coronavirus restrictions will bring people and money into Japan, as a result, the “Reiwa Bubble” occurs.

Secondly, the “Plan B” is as follows:

Exchange intervention will cause the yen to turn from weak to strong, resulting in the formation of a situation similar to “the Heisei bubble.”

In the past, the “Heisei Bubble” began only three months after the world’s attention began to focus on it, as shown in the above article. And now the world is once again focusing on the Japanese yen. What awaits us in the months ahead, after further exchange rate turbulence, may be the Japan’s Bubble.

(Figure: The relationship between the yen-dollar rate and the NI225 in recent months)

(Source: Created by the author based tradingview)

(Reference)

https://asia.nikkei.com/Business/Markets/Yen-falls-to-20-year-low-on-rising-U.S.-Treasury-yields

https://www.bnnbloomberg.ca/goldman-sees-yen-falling-further-with-or-without-intervention-1.1758546

Hiroyasu HARADA

Manager (Senior Analyst), Global Intelligence Group (GIG)