The Possibility of “Japan Bubble” via Global Niche Top: Seeking the Necessities for its Achievement

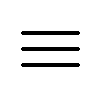

In June 2020, the Ministry of Economy, Trade and Industry (METI) selected 113 companies for the Global Niche Top (GNT) Companies Selection 100 list for the 2020 fiscal year (*1).

Some of the main companies selected are listed below, some of which are publicly listed on the stock market:

(Figure: 2020 Global Niche Top Companies Selection 100 List)

(Source: METI)

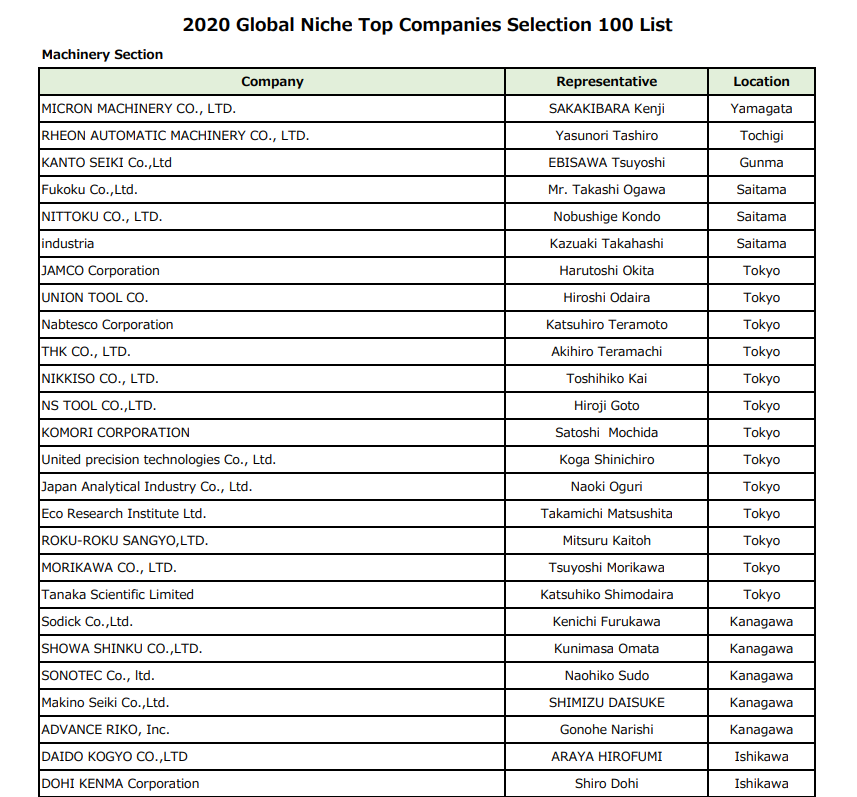

There are many companies in Japan with a small market size but a large global market share and presence. That kind of company is called a GNT company.

Small and medium-sized enterprises, especially in rural areas, were recognised as GNT enterprises after overcoming the high standards and technical hurdles required by their parent companies.

(Figure: Market of Japanese companies)

(Source: METI-Journal)

Economy, Trade and Industry Minister Hiroshi Kajiyama said these companies are “essential and indispensable to global industry, not just Japan’s” at that time.

So, could it be said that the GNT companies will be the trigger for the revival of the Japanese economy, and even for the emergence of a ‘Japanese bubble’?

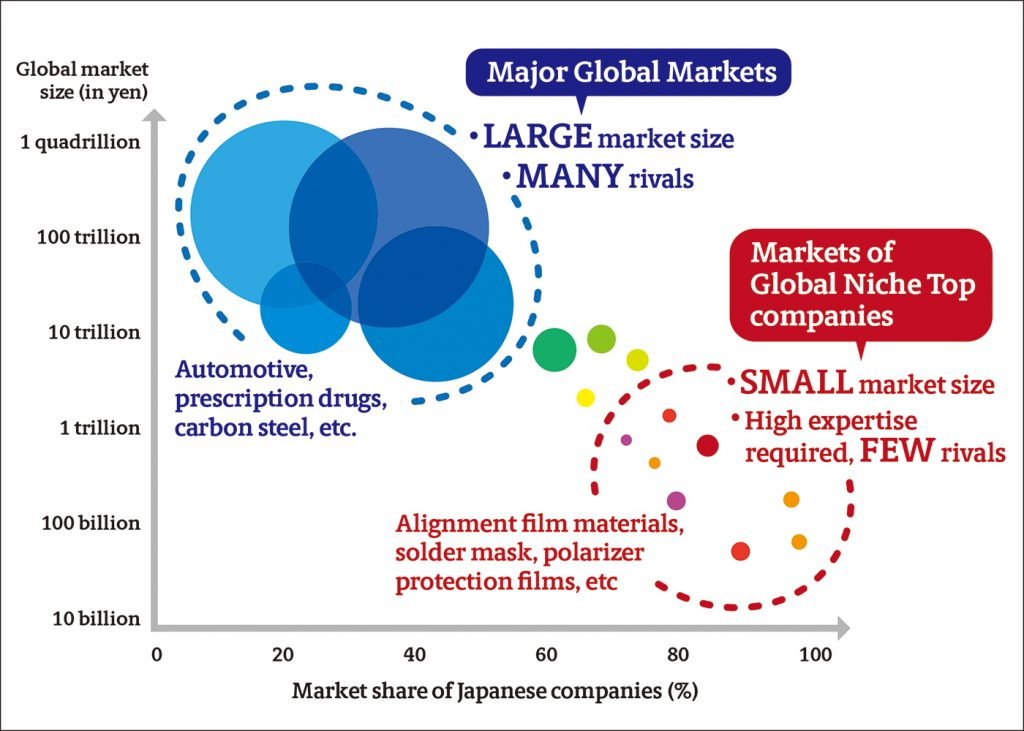

Considering the economy from a macro perspective, i.e. in terms of the increase of national wealth, the trade balance, tourism balance and capital account balance must be improved in order to revive the Japanese economy.

(Figure: Japan’s Main Balance of Payments Indices(2000-18))

(Source: nippon.com)

Although GNT companies have a large market share and essential technologies, there is still a bottleneck of small market size.

The Ministry of Economy, Trade and Industry (METI) says that through this certification, they aim to raise the profile of GNT companies and support their overseas expansion.

However, it should be noted that there are limits to growth strategies that aim to increase the balance of trade in this way. Japan’s export industry no longer has the momentum it once had, and no matter how much benefit there is from the yen’s historic depreciation, this will only last for a limited time.

On the other hand, there is a ray of hope in terms of the tourism balance, taking into account that there will be a complete shift to ‘after-Corona’ from May.

Furthermore, in terms of capital account balance, measures should rather be taken to attract investment from abroad into GNT companies.

(reference)

*1 https://meti-journal.japantimes.co.jp/2020-10-08/

Hiroyasu HARADA

Manager (Senior Analyst), Global Intelligence Group (GIG)