Reconsidering the “Bad” Depreciation of Yen: Japan’s Value as an “Outlier”

“Japan’s economy had been standing on stilts of aids and subsidies when getting to Japan but the Japanese government had to self-support its economy independently after the effectuation of the Treaty.” (*1)

These are the words of Joseph Dodge, who was appointed as MacArthur’s financial advisor and posted to Japan under GHQ rule. With this understanding, a single exchange rate of 360 yen to the dollar, the so-called “Dodge Line,” was established and maintained until the Nixon Shock of 1973.

(Figure: Hayato Ikeda meeting Dodge (right) in 1948)

(Source: Wikipedia)

Since then, the yen has risen and fallen, and on October 31, 2011, the yen strengthened to 75 yen to the dollar. Now, however, the depreciation of the yen is accelerating at a historic rate. On October 20, the yen’s exchange rate against the U.S. dollar temporarily broke through the 150-yen mark, the lowest level in 32 years. Concerns are growing that a weaker currency will continue to fuel inflationary pressures. (*2)

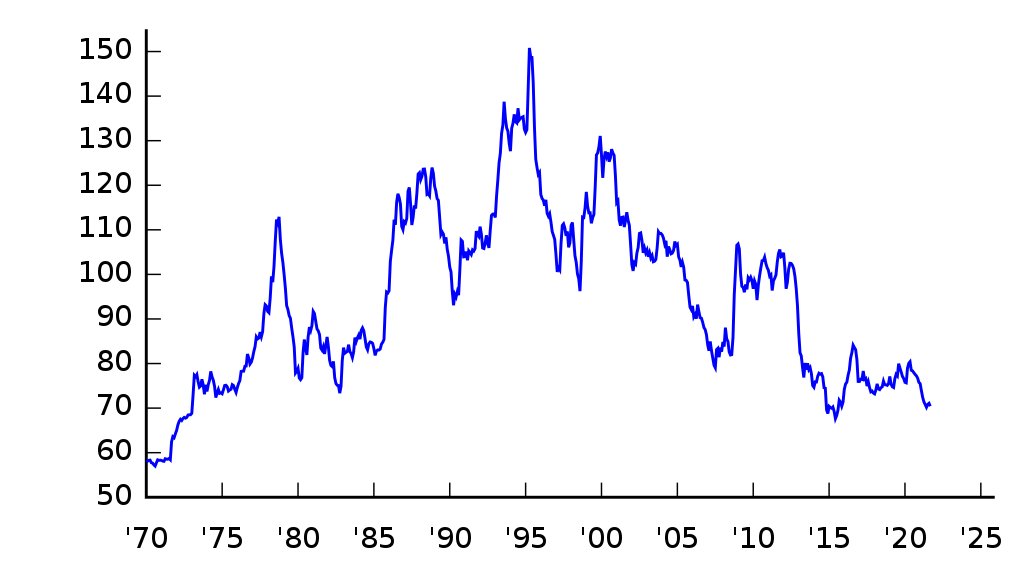

On a real effective exchange rate (REER) basis, this means that the exchange rate has returned to the level of the 1970s. In the 1970s, the Japanese economy underwent a structural transition from high growth to medium growth, which was followed by the “bubble economy” of the late 1980s.

(Figure: Real Effective Exchange Rate (REER) of Japanese yen)

(Source: Wikipedia)

Now, is it possible for Japan’s economy to undergo a structural transformation and create a “Reiwa Bubble” in the same way as in the 1970s?

Certainly, at the present time, a number of companies are recording their highest profits ever, taking advantage of the weak yen. However, in Japan, the negative aspects of the yen’s depreciation are being overemphasized.

Mr. Yanai, Chairman of UNIQLO stated, “Is there anyone who feels the benefits of the weak yen? I think almost no one, even in the manufacturing industry. Rather, it is a disadvantage.” (*3)

The consumer price index in Tokyo in October has risen for the first time in four and a half decades since June 1982, excluding the impact of the consumption tax hike, and households are further increasing the burden on their budgets. (*4)

(Figure: Beef bowl (Gyudon), which is often regarded

as the standard for prices in Japan)

(Source: Endeus.TV)

So, is the current depreciation of the yen really “totally bad” for all but a few companies? From the start, the only way to grow the economy in resource-poor Japan is to rely on trade or tourism. The number of foreign tourists is currently increasing rapidly based on the weak yen, and inbound consumption is expected to be quite promising. Furthermore, trade is also generally beneficial for exporters of goods that are not offset by imports of resources.

Then, are there any benefits other than for exporters? Globally looking at money flows, it can be said that Japanese exporters are currently making money in dollars at their overseas subsidiaries.

However, the dollars thus made are remitted to Japan by repatriation at the time of closing.

If this happens, following the “Le Chatelier principle,” the current depreciation of the yen will reverse sharply to a stronger yen. This would be the turn of non-exporting firms.

Furthermore, there are indications that the dollar will tend to appreciate against the yen until the midterm elections, after which it is likely to weaken against the dollar and appreciate against the yen. (*5)

“Be prepared.” This is the motto of the Boy Scouts of America. With the current drastic change in the exchange rate, this motto is needed now more than ever!

(reference)

*1 https://www.esri.cao.go.jp/jp/esri/archive/e_rnote/e_rnote030/e_rnote027.pdf

*2 https://www.japantimes.co.jp/news/2022/10/20/business/financial-markets/yen-150-pressure-mounts/

*3 https://www.asahi.com/articles/ASQBF640CQBFULFA02L.html

*4 https://www.japantimes.co.jp/news/2022/10/28/business/tokyo-inflation-40-year-high/

*5 https://www.smd-am.co.jp/market/ichikawa/2018/10/irepo181002/

Hiroyasu HARADA

Manager (Senior Analyst), Global Intelligence Group (GIG)