Poverty “UN SDGs and Pax Japonica” Vol. 4

“If they don’t have bread, let them eat cake.”

It is a famous phrase that Marie Antoinette was said to have said. It is generally accepted that these words were not uttered by Marie Antoinette, but they can be said to describe the state of poverty at the time. Similar episodes have survived in China and Japan. Extreme poverty, hunger, and inequality are problems that exist in every region.

So, what is poverty?

This is a series of articles called UN SDGs and Pax Japonica, and this time I would like to think about poverty, which is the first of the 17 SDGs.The UN SDGs describe poverty as “ending poverty in all its forms, everywhere.” According to the UN’s SDG Report 2023: Special Edition, 575 million people will still live in extreme poverty by 2030 if current trends continue. Only one-third of countries can halve the level of poverty among their citizens. Especially in Africa and South America, there are people living in “absolute poverty” and living on less than about 200 yen a day, which is still an issue.

As a means of reducing extreme poverty, financial services and microfinance that serve the poor as customers have also attracted attention. It allows the poor who cannot open an account and cannot use general financial services to receive loans, deposits, insurance, and remittances. Poor people may be able to get small loans, start small businesses, and make a living on their own. In 2006, Grameen Bank, founded by Dr. Muhammad Yunus, was awarded the Nobel Peace Prize for helping the poor through microinvestment. In order to make a living, to support their children, they act desperately with the money of even a small loan. Many women escaped poverty through businesses such as bamboo crafts and pottery making. However, it doesn’t always seem to work. According to [Kara, et. 21], microfinance can be a barrier to economic growth. There is also a possibility that borrowers who have been excluded will fall into excessive debt. It is important not only to lend but also to acquire financial literacy.

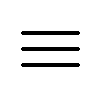

Speaking of financial literacy, what about Japan? According to the Financial Literacy Survey in Japan conducted by the Central Committee for Financial Services Public Relations, the response rate to questions about financial knowledge and judgment has remained almost flat from 2016 to 2022, and there has been no improvement.

In Japan, money is treated as dirty, and I feel that there are times when basic money is not studied at school or at home. In the Edo Era, Tokugawa Ieyasu suppressed the discontent of the people by saying that the merchant, the only one with a large amount of money among the samurai, farmers, and merchants, was the lowliest of the greedy, dirty and gold-covered status. He instilled the notion that frugality is a virtue. It is said that it has survived to the present day.

Many argue that we need to change our mindset about money in order to get out of poverty, but the feeling that has been handed down since the Edo period may not change overnight.

Going back to SDG 17, Japan has not achieved its poverty target. “Relative poverty” is probably a bigger challenge than “absolute poverty.”

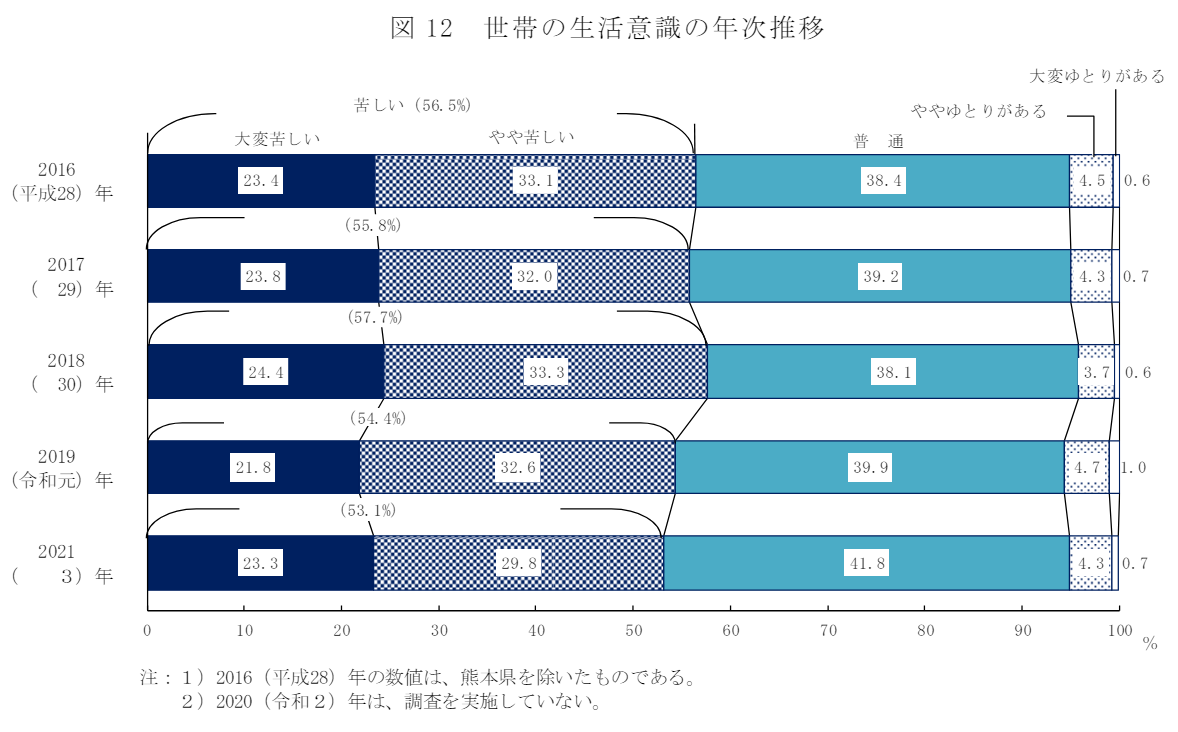

It is said that there are many people, especially children, single mothers, and the elderly, who live in relative poverty. “Relative poverty” is more difficult to define, and I also think about what “poverty” is. According to the Basic Survey on Living Conditions, half of the respondents said that their households’ sense of life was difficult, and there are probably many cases where people who do not generally say that they are “poor” feel that their lives are difficult.

What is also worrisome is that there may actually be cases of poverty even though these people do not feel that poverty or life is difficult. For example, if you are single in your 20s, you can get a part-time job at 1,113 yen, which is the minimum wage in Tokyo, and you can live well if you stay away from the city center for a while and keep your rent down. There are many products that sell at low prices, such as 100 yen shops and beef bowl chain stores, so even if you don’t have a high income, you won’t feel inconvenienced. If you go on a trip abroad, you may see the difference in prices, but you will not feel poverty unless you go outside the framework of the same standard of living as yourself. Some people may think that it is enough to live the same life as those around them and live without inconvenience, and do not make any special effort to earn money. That’s fine when you’re young and healthy, but when you get older, things suddenly change. You may become ill and unable to work, and you may suddenly feel poor. In addition, workers from overseas and AI may suddenly eliminate even part-time jobs. If you don’t make an effort to acquire literacy without being aware of your situation, by the time you do, it will be too late.

The question of 20 million yen after retirement remains as to whether 20 million yen is really enough, but it is clear that it is necessary to prepare for retirement in terms of money. If you reach retirement age and retire at the age of 60 and live to be 100 years old, you have 40 years left. If you started working at the age of 20, you have the same number of years of time you don’t work as you did when you were working. How many people can retire without lowering their standard of living?

Corporating Planning Group,

Risako Ikeda

[Kara, et. 21]Kara, Alper, Haoyong Zhou, and Yifan Zhou. “Achieving the United Nations’ sustainable development goals through financial inclusion: A systematic literature review of access to finance across the globe.” International Review of Financial Analysis 77 (2021): 101833.

[Gatto, et. 22]Gatto, Andrea, and Elkhan Richard Sadik-Zada. “Access to microfinance as a resilience policy to address sustainable development goals: A content analysis.” Heliyon 8.10 (2022).