“Hometown Tax Syndrome” ~A Critical Situation of Rights and Duties~

(Source: photo-ac)

On the whole, our daily life and the tax payment system are closely linked. There are a lot of public services such as social security, infrastructure, education, police services, fire prevention, and defense services. These services have a significant role to save our untroubled living conditions. In other words, the roles of public sectors are realized by using taxes. Therefore, we have to share the cost of many public services. Accordingly, payment of taxes composes our three major duties with education, work in Japan. It is said that we have rights and yet corresponding duties at the same time.

(Figure: Taxes and Public Services)

(Source: The Ministry of Finance)

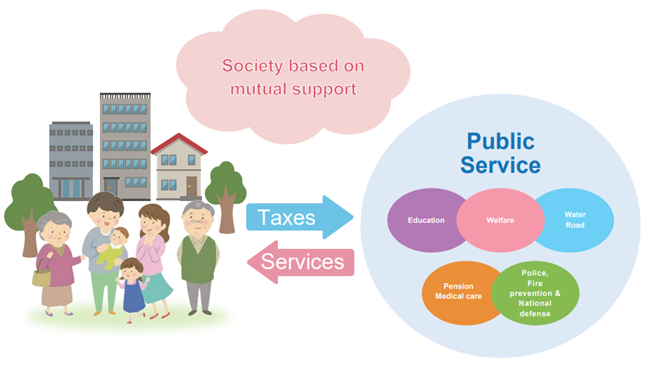

However, it is believed that the principles of rights and duties face a difficulty in Japan. We can point to the Japanese Hometown Tax System as an example of the problem. The system can provide some merits to taxpayers, for example if they donate to self-selected local governments, they can take income and resident tax deductions for the entire amount of their donations less 2,000 yen and get some return gifts. In 2020, the total revenue by the Hometown Tax reached 672.5 billion, which means that the number hit a record high.

(Figure: Growth of the Hometown Tax System)

(Source: nippon.com)

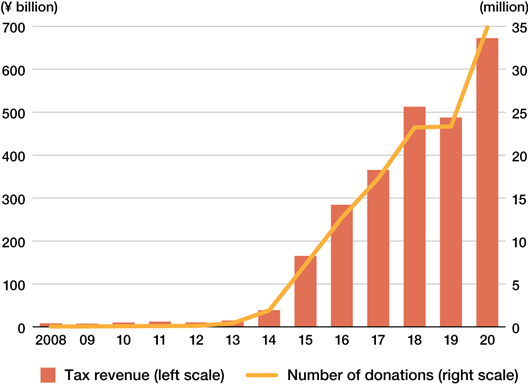

On the other hand, it is said that the main purpose of the system is to reduce the gap of the unbalanced tax revenue between urban cities and rural areas. However, the system is seemed to be failed to achieve such an ideal goal. The image shows the net cash flow from the Hometown Tax donation program in FY2015 and the per capita amount of tax revenue for each local government in FY2014. We can see that net cash flow differs according to municipalities. It means that the number of local governments which can get more tax revenue is extremely limited.

(Figure: The relation between The Hometown Tax system and Tax Revenue)

(Source: RIETI)

In addition, the Hometown Tax System provided unexpected phenomenon because many local governments compete for acquiring more tax revenue by using the system excessively. As a result, return gifts to give taxpayers have become more generous and valuable items such as luxury food products and electronic equipment. It seems to detach from original vision. Therefore, the system was reformed only slightly to reduce excessive competition between municipalities in 2019. However, it may be difficult to solve the problem completely as the heat of the Hometown Tax has sustained. Although the system can provide a lot of merits to taxpayers in terms of a variety of return goods, the system could damage the principle which means that People have to widely and fairly share the costs to support public services. Such a system could make a relationship between costs and benefits unclear.

In conclusion, paying taxes is everyone’s duty derived from principles enshrined in the Japanese Constitution which has an origin in German public law, therefore, it could be argued that the Hometown Tax spawns a new concept which shows freedom from states. However, the Hometown Tax System needs to be improved to achieve one’s intended purposes. Moreover, as I mentioned above, the system had an impact for many taxpayers, therefore, it may provide a good chance of reviewing the role of tax.

Masatsugu KURAMOCHI

Analyst, Global Intelligence Group (GIG)

(Reference)

https://www.mof.go.jp/english/policy/tax_policy/publication/tax011/index.htm

https://www.nippon.com/en/japan-data/h01108/

https://www.rieti.go.jp/en/papers/contribution/sato-motohiro/02.html#:~:text=The%20hometown%20tax%20donation%20program%20has%20been%20serving%20as%20a,the%20amount%20of%20annual%20income.

https://www.nta.go.jp/english/index.htm

https://www.tokyoweekender.com/2021/11/furusato-nozei-japan-hometown-tax/