Approaching the Key to Success of Kishida’s “New Capitalism” from Historical Retrospect

The Kishida administration’s centerpiece policy, “new capitalism,” has begun to take off. This plan focuses on investment in four areas: “people,” “science, technology, and innovation,” “startups,” and “green and digital.” On the other hand, the following criticisms have been raised, as usual (*1):

●No different from “Abenomics” (Abe’s economic policies) when the veil is removed

●A Shortage of Novelty

(Figure: Prime Minister Kishida explains “New Capitalism”)

(Source: Japan times)

So, what is the key to the success of this plan? In this context, there was a plan implemented by past Japanese administrations on which the Kishida Plan would be based. The plan was the “Income Doubling Plan” initiated by Prime Minister Hayato Ikeda in the fall of 1960. In this report, I would like to review the merits and demerits of the Ikeda Plan as a basis for considering the future of the Kishida Plan.

What was the situation in Japan at the time this plan was formulated? The “Economic White Paper” issued by the Economic Planning Agency in 1956 contains the following statement (*2):

●The buoyancy provided by the economic recovery has now been largely exhausted

●Japan is still poor, but the potential demand for consumption and investment is high compared to the rest of the world

●The postwar period is over

●We are now facing a different situation. Growth through recovery is over. Future growth will be supported by modernization.

Under such economic conditions, the Ikeda plan set a goal of doubling real GNP to 26 trillion yen over the next 10 years from 1961, but the Japanese economy subsequently grew beyond the plan.

(Figure: June 1961 summit meeting in Washington D.C.

between Hayato Ikeda (second from left) And John F. Kennedy (fourth from left))

(Source: Wikipedia)

A key person in reviewing the Ikeda Plan is Osamu Shimomura, a finance bureaucrat who was Prime Minister Ikeda’s brain. He developed his own growth theory at about the same time Harrod and Dormer established theirs.

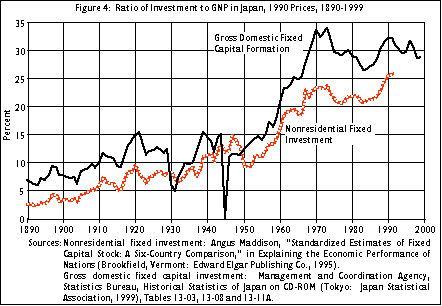

Based on this theory, the Ikeda Plan allowed the Japanese economy to achieve rapid growth without high inflation, by expanding production capacity to meet growing demand through aggressive capital investment. Gross fixed capital formation soared to more than one-third of GNP in 1970 (*3). It is clear that if we fear inflation, we should not restrain investment, but rather augment supply capacity through aggressive investment.

(Figure: Ratio of Investment to GNP in Japan)

(Source: JET REPORT)

The 1970 “White Paper on the Economy” also shows how much weight is still being paid to capital investment.

In fiscal 1969, private-sector capital investment continued to expand beyond expectations, reaching 12.8 trillion yen, up 29.8% from the previous year, and has continued to grow by more than 20% per year for the past four years.

However, we must not forget that what the massive capital investment brought about was not only economic growth but also negative externality such as pollution. The Ikeda Plan brought about a rapid increase in industrial production and energy consumption, accompanying an increase in smoke and wastewater emissions from factories, causing widespread air and water pollution and other problems.

(Figure: Thick fumes from industrial complex cover the area in Amagasaki,

Hyogo Prefecture in 1970)

(Source: PHYS)

The basic viewpoint of “the interrelationship between production capacity and demand” is still valid half a century later. If we focus on this point, the “new capitalism” would be a second “income-doubling plan.”

(Reference)

*1 https://www.nippon.com/en/in-depth/d00804/

*2 https://www.meti.go.jp/english/report/index_whitepaper.html

*3 http://www.jei.org/Restricted/JEIR00/0003f.html

Hiroyasu HARADA

Manager (Senior Analyst), Global Intelligence Group (GIG)